Not-For-Profit Accounting & Bookkeeping Services

Our Mission is to Focus on your Back-Office Support,

so you can Stay Focused on your Mission

Irrespective of the type of non-profit organization you run, we draw on our experience to help navigate your compliance landscape and varied reporting requirements while also enhancing financial controls and transparency, and maximizing your limited resources to meet greater needs without adding to overhead costs. We understand that when non-profit organizations are unable to meet their goals, it doesn’t just disappoint board members, it also prevents them from meeting their commitment to fulfilling their mission. Our domain expertise allows us to understand your unique issues and challenges, helping to turn those into proactive actions in order to deliver the services needed.

Our services specifically for the Not-For-Profit industry:- Program Cost Allocation

- Manage Revenue Streams

- Government Compliance Requirements

- Single Audit Act Requirements & Compliance

- Tracking of Donor Gift Restrictions

- Functional Budgeting

- Funder Reporting

- Intermediary Funder Compliance for Pass-Through Grants

- GATA Compliance

- Investment/Endowment Tracking

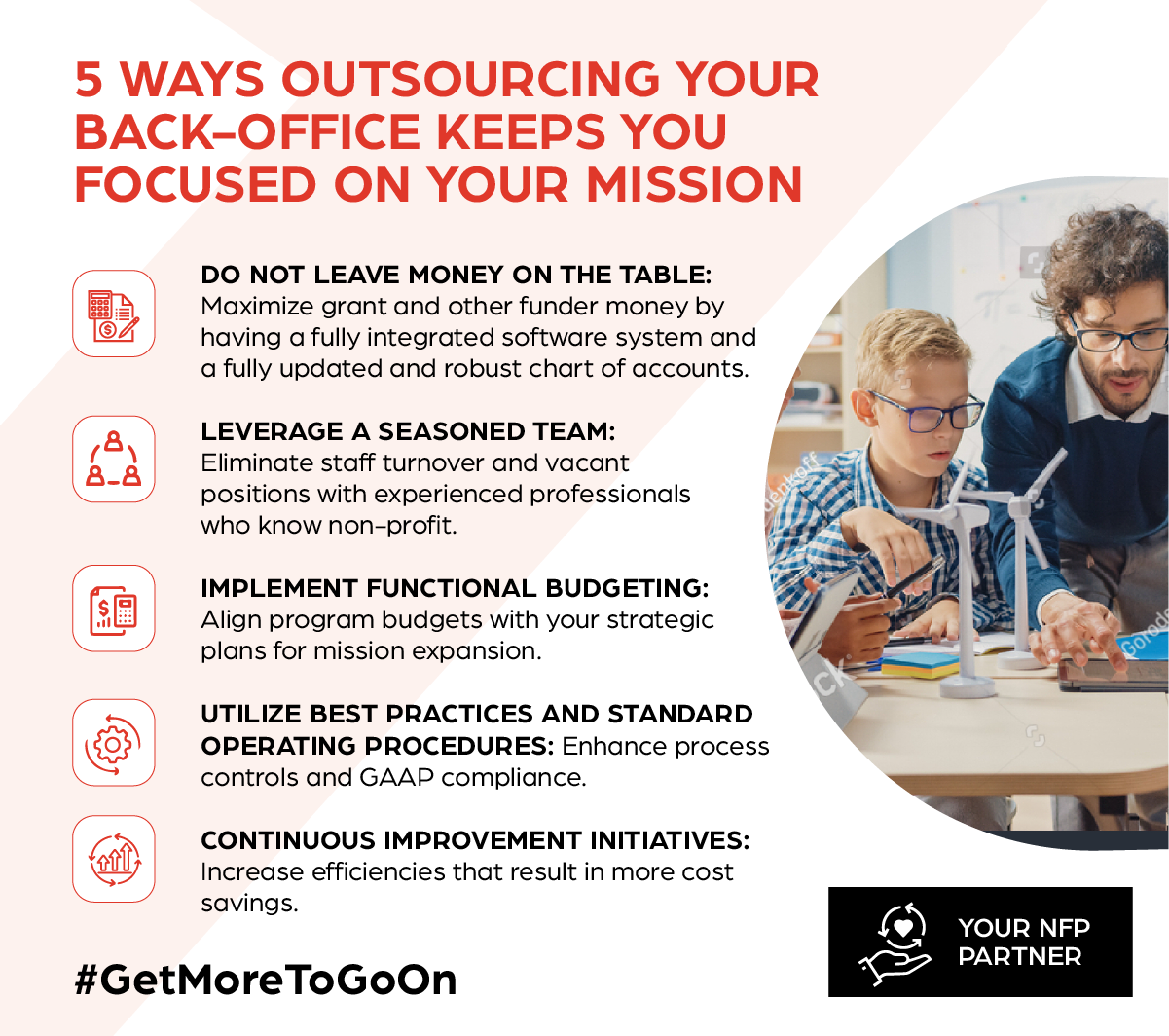

By partnering with QBSS, an accurate and reliable service provider, non-profit organizations are empowered to:

- Leverage accounting best practices and highly trained accounting professionals with deep domain expertise

- Strengthen financial controls through segregation of duties and accountability

- Optimize cash flow through timely and accurate reporting to external funding sources

- Increase financial transparency through enhanced internal reporting

- Improve accounts payable, budget facilitation, financial forecasting and cash flow management processes

We give you more to go on. Providing measurable benefits as well as intangible value enabling you to focus on your mission and not your back-office.

Impact delivered

3,500+

Financials Delivered

Each Month

1 million+

Bank Transactions Reconciled

Each Month

1.6 million+

AP Invoices Processed

Each Year

our solutions

For the Not-For-Profit Industry

QBSS serves non-profit organizations by providing a clear, actionable, consistent picture of their financial position, while improving and effectively managing the human and technology capabilities as well.

Finance and Accounting Services

- Record to Report

- Procure to Pay

- Order to Cash

- Financial Model Development

- CFO Advisory

- Policies and Procedures Evaluations

HR Services

- HR Advisory

- HR Operations

- Talent Acquisition & Development

Technology Services

- Professional and Cloud Services

- Cybersecurity Services

- Managed IT Services

- Business Enablement Services

- Mobility Services

Clients in the Not-For-Profit Sector

Latest Insights