Blog Details

From Headwinds to Action: Why Restaurant Operators Must Tackle G&A to Survive 2025

September 16, 2025

The U.S. restaurant industry — and quick-service restaurants (QSRs) in particular — has been navigating an unforgiving economic environment for several years. As we move through 2025, pressures have only intensified. Margins are being squeezed on all fronts — from food and labor to customer acquisition, declining demand, and real estate.

While many of these headwinds are outside operators’ control, one area remains largely within their grasp: general and administrative (G&A) expenses. Tackling G&A through technology, outsourcing, and best practices can provide operators with the cost relief and agility they need to weather today’s storm and prepare for long-term competitiveness.

By applying discipline to G&A through outsourcing, automation, and best practices, operators can:

While many of these headwinds are outside operators’ control, one area remains largely within their grasp: general and administrative (G&A) expenses. Tackling G&A through technology, outsourcing, and best practices can provide operators with the cost relief and agility they need to weather today’s storm and prepare for long-term competitiveness.

The Pressures on Profitability

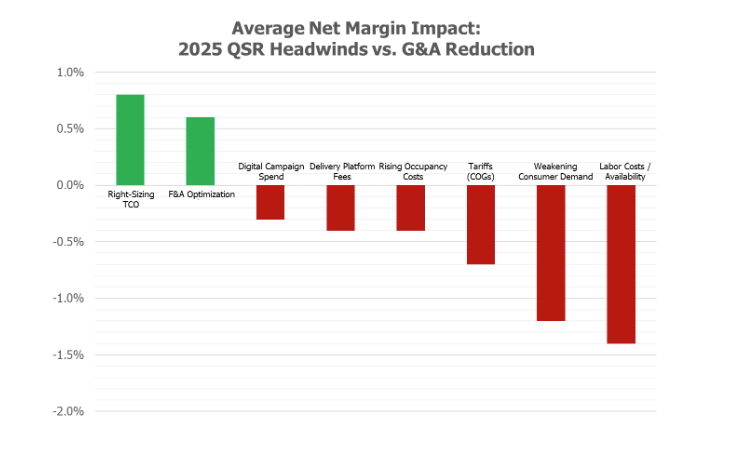

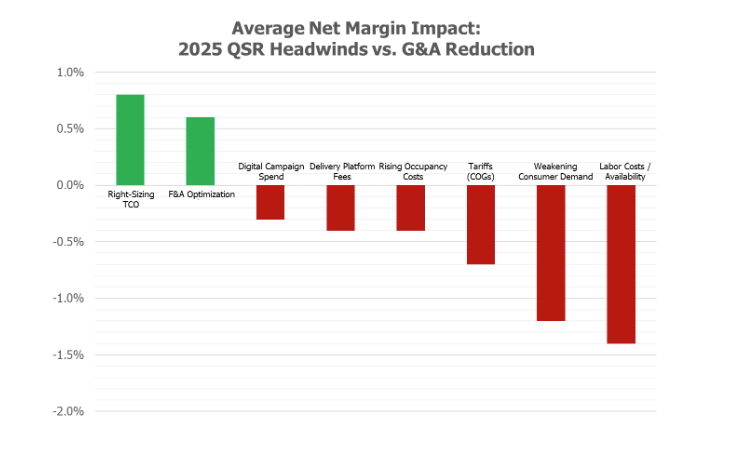

1. Tariffs Driving Food and Packaging Inflation

Tariffs enacted in early 2025 are already adding an estimated 2–3% to supply chain costs, with certain specialty ingredients seeing even sharper hikes. Imported staples such as coffee, chocolate, seafood, and specialty oils are becoming significantly more expensive, forcing operators to adjust menus and raise prices. Distributors are passing costs directly to restaurants, raising the baseline cost of goods sold (COGS) across the board.2. Tightening Labor Supply

Labor shortages have become more acute as immigration enforcement and policy changes constrain a workforce where more than 20% of employees are foreign-born. Operators are being forced to increase wages — in some cases by as much as $3 per hour just to maintain staffing levels. Absenteeism and turnover add further operational strain.3. Inflation and Consumer Pullback

The food-away-from-home CPI rose 3.9% year-over-year in the first quarter of 2025, straining household budgets and dampening consumer sentiment. Analysts forecast consumers will spend 7% less on restaurants this fall as compared with last year. For many brands, “value meals” are no longer a marketing tool — they’re a survival tactic. Compounding the issue, the current tariff environment functions much like a regressive tax: it disproportionately impacts lower-income households, who spend a higher share of their income on food. As these added costs ripple through supply chains and into menu prices, they will further dampen consumer spending — particularly at QSRs that rely most heavily on price-sensitive customers.4. Rising Customer Acquisition Costs

Customer acquisition is becoming more expensive as the digital platforms, controlled by a handful of large technology companies, dominate access to diners. In fact, ad benchmarks show that digital campaign costs are rising, while delivering lower conversion rates. Restaurants face a double bind: spend more to get less, or risk being invisible to customers.5. The Hidden Tax of Delivery Fees

Third-party delivery apps typically take 15–30% in commissions, with surcharges often pushing the true cost above 35%. Consolidation among major players (DoorDash, Uber Eats, Grubhub) has eroded restaurants’ bargaining power. The result: barely break-even margins on delivered meals and delivery menu prices now average 26% higher than dine-in, discouraging repeat patronage.6. Occupancy Costs Rising Faster Than Sales

Historically one of the “big three” restaurant costs, occupancy is becoming a growing profitability threat. Nationally, restaurant rents rose 6.7% in 2024, outpacing both food-away-from-home inflation and overall CPI. In markets like New York, Miami, and Los Angeles, prime space rents jumped 10–15%. Fixed costs like rent, CAM charges, property taxes, and insurance leave operators little room to maneuver in downturns. The National Restaurant Association reported that these costs are expected to accelerate further in 2025.The Controllable Lever: G&A Expense Reduction

While food, labor, tariffs, delivery fees, and rent remain largely outside an operator’s control, G&A offers a real opportunity to act. For multi-unit and multi-brand operators, G&A often consumes 5–10% of revenue — a meaningful lever in a low-margin industry.Finance & Accounting (F&A)

Transactional accounting, reporting, and compliance consume significant resources without the right systems and structure. Top-performing operators spend 1–2% of revenue on finance, while laggards spend two to three times as much. Centralizing and outsourcing these activities can cut costs 20–40% while improving accuracy and reporting speed. Increasingly, operators are adopting AI-enabled automation for invoice processing, reconciliations, and reporting to drive even greater efficiency.Information Technology (IT)

Modern restaurant organizations run on a complex stack of technology: point-of-sale (POS), payroll, online ordering, loyalty, inventory, and analytics. Maintaining and securing this ecosystem typically costs 2–3% of revenue. Rightsizing the total cost of ownership (TCO) of these systems through outsourcing support and leveraging automation can reduce TCO by 10–20%, improve incident resolution, and mitigate cyber risks — all while reducing dependency on scarce IT talent.

Why Acting Now Matters

Most of today’s pressures — tariffs, immigration policy, inflation, digital marketing, delivery fees, rising rents — are policy-driven or market-driven forces beyond operators’ control. But, much of G&A spend is controllable.By applying discipline to G&A through outsourcing, automation, and best practices, operators can:

- Free up capital to reinvest in pricing strategy, menu innovation, and customer engagement.

- Protect margins and competitiveness in the face of structural headwinds.

- Improve operational agility in an increasingly volatile market.

Latest Insights

Related Blogs

Contact Us