Blog Details

Beyond the Ledger: How Modern CFOs Drive Strategic Growth

June 3, 2025

In today’s rapidly evolving business landscape, mid-market CFOs find themselves at a crucial crossroads. The traditional view of finance leaders as number-crunchers and operational managers is giving way to something far more impactful—strategic growth leaders who shape the future of their organizations. This transformation isn’t merely optional; it’s becoming essential for competitive survival, particularly in private equity environments where value creation timelines are extending, and operational excellence is paramount.

The Strategic Dilemma: Trapped in Transactional Quicksand

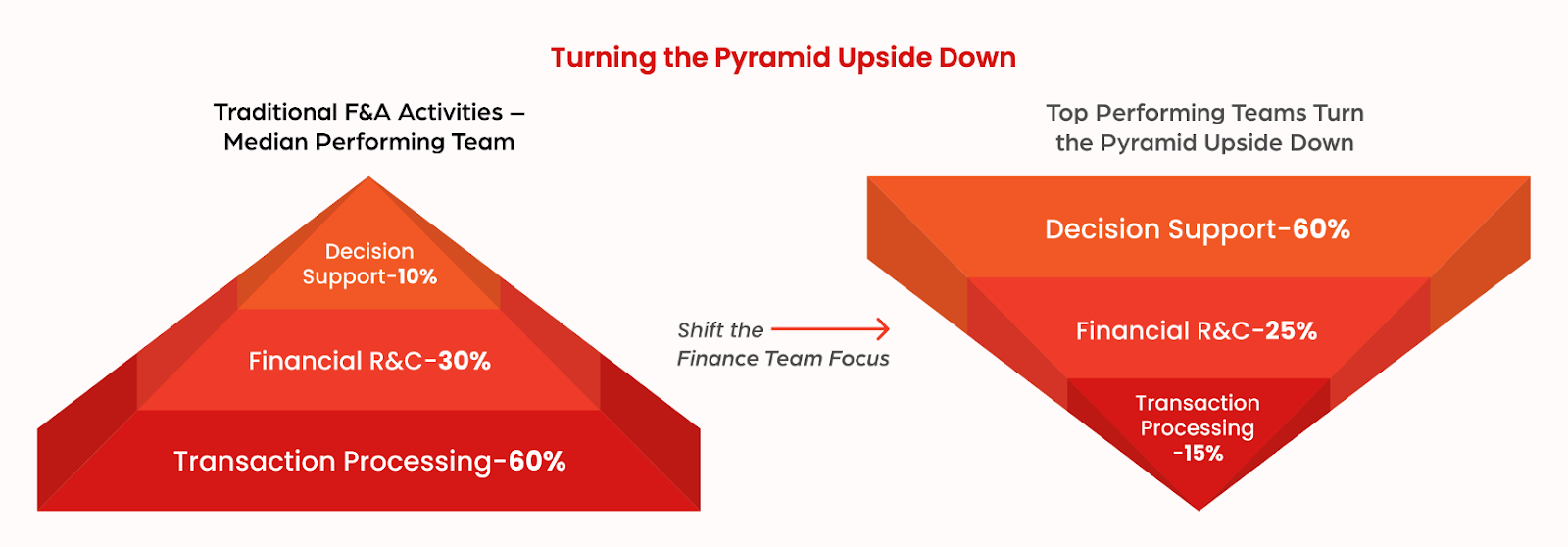

Most mid-market finance departments face a common challenge that has reached crisis proportions: they’re drowning in transactions while starving for strategy. Studies consistently show that average finance teams spend a staggering 60% of their time processing transactions, 25% on reporting and control functions, leaving a mere 10% for what truly matters—strategic decision support that drives growth and creates enterprise value.

This imbalance creates a debilitating paradox. The very people with the financial expertise to guide strategic growth are consumed by day-to-day operations, unable to leverage their insights where they would create the most value. When CFOs and their teams are perpetually buried in accounts payable processes, month-end close processes, and compliance documentation, they become tactical executors rather than strategic visionaries.

For mid-market companies, especially those backed by private equity, this represents an enormous opportunity cost. Every hour spent on routine transactions is an hour not devoted to identifying margin improvement opportunities, optimizing capital allocation, or developing financial strategies that support organizational growth.

Flipping the Financial Pyramid: A Radical Realignment

Forward-thinking organizations are challenging this status quo by completely inverting the traditional finance model. This isn’t about incremental improvement but rather a fundamental rethinking of the finance function’s purpose and priorities.

Rather than allowing transactional work to dominate, leading organizations are creating a new paradigm where:- Strategic decision support expands dramatically from 10% to 60% of the finance team&’s focus

- Transaction processing shrinks from most of the effort to just 15%

- Reporting and control functions streamline to 25% of overall activity

This transformation represents more than a reorganization—it&’s a complete reimagining of finance&’s role within the business ecosystem. When finance teams dedicate the majority of their intellectual capital to strategic initiatives, they become engines of growth rather than necessary cost centers.

The results of this inversion are profound. Finance departments that have successfully flipped their operational model report significantly improved business partnerships, more proactively identified risks and opportunities, and measurably enhanced contributions to enterprise value creation.

Technology as the Transformation Catalyst: Beyond Basic Automation

The key enabler in this transformation is technology, but not merely as an efficiency tool. Today’s finance leaders are leveraging sophisticated technological ecosystems that fundamentally redefine what’s possible:

Intelligent Automation

: Far beyond basic rule-based processing, modern financial automation incorporates machine learning (ML) to handle increasingly complex workflows with minimal human intervention. These systems can process invoices, reconcile accounts, manage payables and receivables, and execute routine compliance tasks with greater accuracy and significantly less human oversight than traditional approaches.Advanced Analytics and AI

: The most sophisticated finance departments are deploying tools that don’t just report historical performance but predict future outcomes and recommend specific actions. These predictive capabilities allow finance teams to identify emerging risks, uncover hidden cost-saving opportunities, and develop more accurate forecasting models that drive better decision-making across the organization.Cloud-Based Financial Platforms

: Integrated cloud environments create unified data ecosystems where financial information flows seamlessly across the organization. These platforms eliminate the data silos that have traditionally plagued finance departments, replacing them with single sources of truth that provide real-time insights accessible to stakeholders throughout the business.Visualization and Communication Tools

: As finance shifts toward strategic support, the ability to communicate complex financial concepts to non-financial stakeholders becomes crucial. Modern visualization tools transform raw financial data into compelling narratives that drive action and understanding.

These technologies aren’t just improving efficiency—they’re fundamentally changing what’s possible for finance teams to accomplish. By automating routine processes, they free human capital for higher-value activities while simultaneously improving accuracy and reducing risk.

The Private Equity Context: Heightened Urgency for Transformation

For private equity backed companies, this evolution carries even greater significance and urgency. The macroeconomic environment has shifted dramatically, creating new pressures and priorities. With looming tariff concerns and other economic environment uncertainty, PE firms are extending holding periods and focusing intensely on optimizing current portfolio companies rather than rapidly pursuing new acquisitions.

The emphasis has shifted from transaction velocity to value creation within existing investments. This means PE operating partners are scrutinizing efficiency and cost structures more thoroughly than ever before, creating both pressure and opportunity for CFOs who can pivot to strategic leadership.

In this environment, PE-backed CFOs who remain mired in transactional activities risk being viewed as impediments to value creation rather than catalysts for it. Conversely, those who successfully transform their finance functions become indispensable partners in driving EBITDA growth and preparing organizations for eventual exits at premium valuations.

Beyond Numbers: The Evolved CFO Skillset

As financial leaders navigate this transition, the skills that define success are evolving beyond traditional accounting and financial management competencies:

Business Partnership

: Today’s most effective CFOs work seamlessly across departments to identify growth opportunities, challenge assumptions, and provide financial insights that inform product development, marketing strategies, and operational improvements. They’re true business partners, not just financial gatekeepers.Strategic Vision

: Leading CFOs see beyond immediate financial metrics to understand long-term value creation. They can translate business strategies into financial roadmaps and identify the key performance indicators that will drive sustainable growth.Change Leadership

: Transforming finance from a transactional to a strategic function requires significant organizational change. Successful CFOs must be adept at guiding their teams through this evolution, helping finance professionals develop new skills and embrace new ways of working.Technology Fluency

: While CFOs don’t need to be technologists, they must understand how to leverage new tools to unlock insights. This includes understanding which processes can be automated, best practices to structure data for maximum utility, and how to evaluate the ROI of technology investments.Risk Intelligence

: Rather than simply identifying risks, strategic CFOs develop sophisticated frameworks for assessing, prioritizing, and mitigating various types of financial, operational, and strategic risks. This forward-looking approach supports more confident decision-making throughout the organization.

The most successful CFOs maintain a delicate balance between technical financial expertise and these broader leadership capabilities, becoming true strategic partners to CEOs and boards.

The Path Forward: Practical Steps Toward Transformation

For mid-market CFOs looking to lead this transformation, the journey begins with several concrete steps:

Assess Current Reality

: Rigorously measure how your finance team currently allocates time across transaction processing, reporting, and decision support. This baseline understanding is essential for tracking progress and identifying priority areas for improvement.Identify Technology Opportunities

: Conduct a comprehensive audit of your financial processes to determine which offer the greatest potential for automation and enhanced analytics. Prioritize initiatives based on both potential impact and implementation complexity.Develop a Transformation Roadmap

: Create a phased plan for implementing new technologies, evolving team structures, and developing new capabilities. Include clear milestones and metrics to track progress.Redefine Success Metrics

: Establish new performance indicators that measure finance’s contribution to strategic outcomes, not just operational efficiency. These might include metrics related to forecast accuracy, decision support quality, and business partner satisfaction.Invest in Change Management

: Recognize that transforming finance is as much about cultural and behavioral change as it is about technology implementation. Invest time and resources in helping your team understand and embrace their evolving roles.

The most important step is simply beginning the journey. While perfect solutions may not exist, the cost of maintaining the status quo far exceeds the risk of transformation. Even incremental progress toward a more strategic finance function can yield significant returns in terms of organizational performance and competitive advantage.

Conclusion: The Strategic Imperative

The future indisputably belongs to CFOs who can transcend their traditional roles and emerge as true strategic partners driving enterprise value. By embracing technology, rethinking processes, and developing new capabilities, finance leaders can flip the traditional model and unlock their true potential.

For mid-market companies, especially those with private equity backing, this transformation isn’t merely about finance department efficiency—it’s about creating a strategic advantage that drives sustainable growth, increases operational resilience, and ultimately enhances enterprise value.

The question isn’t whether mid-market CFOs should make this transition—it’s whether they’ll do it quickly enough to thrive in an increasingly competitive landscape where strategic financial leadership is becoming the difference between market leadership and obsolescence.

Those who successfully navigate this evolution will find themselves not just keeping pace with change but actively shaping the future of their organizations from a position of unprecedented influence and impact.