Blog Details

Payroll Fraud – A Major Threat for SMBs & How Can It Be Minimized

April 7, 2019

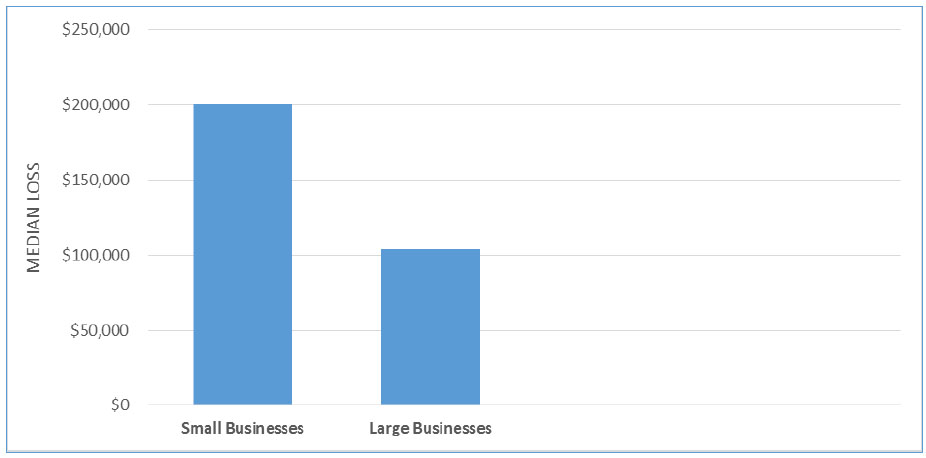

Fraud poses an incredible threat to organizations of all types and sizes, in all parts of the world. The occurrence of fraud may also expose businesses to civil or criminal liabilities. Small businesses are not immune to fraud instances, rather they are the easiest prey for any fraudulent activity to happen. According to the 2018 report by The Association of Certified Fraud Examiners (ACFE), the median loss due to fraud for small businesses is $200,000 versus $104,000 for large businesses.

According to the association of certified fraud examiners, payroll fraud is the #1 source of losses to us businesses.

Payroll fraud is committed in various forms such as falsified wages and commissions, faking injuries for the insurance claims, false invoicing or having ghost employees. The reality is, payroll fraud is not always preventable. The key is to catch the fraud and minimize the risk. The best way to minimize fraud risk is to reconcile payroll at least on a quarterly basis.

Median loss due to fraud for small and large businesses

Among all the types of fraud that can occur, payroll fraud is a severe threat for SMBs that have not safeguarded themselves properly. Payroll fraud that occurs within an SMB can lead to complications with the business’s account, and can grow from a small dent in the company coffers to a major financial drain.

This article outlines the ways in which smbs can minimize the risk of payroll fraud

1. Bank ReconciliationBank reconciliation is a critical accounting procedure which ensures that the cash balance shown on a company’s balance sheet and bank statement is accurate. Completing monthly bank reconciliations enable SMB owners to identify and explain differences that may result from the timing of posted activities, errors made by the bank or the company or fraudulent activities of a company’s employees.

2. Conduct Surprise AuditsConducting a surprise payroll audit always works in the favor of an SMB as it helps to minimize both financial and regulatory risks by giving owners the opportunity to correct the problems proactively. Many unscrupulous employees anticipate any regular audits that occur and cover their tracks accordingly, but a surprise audit can help in exposing the usually hidden discrepancies. Also, the simple threat of audit can deter fraudulent employee behavior.

According to the acfe, 12% of small businesses detect fraud by conducting internal surprise audits

3. Go ExternalSMBs can eliminate the risk of in-house fraud and can feel secure in knowing that their payroll is being handled appropriately by using an outsourced payroll service provider. These providers have sophisticated systems in place to catch payroll abuses and then alert clients to the possibility of payroll irregularities. Also, they stay current on all federal, state and local regulations in a way that a small or medium business just can’t, giving owners’ peace of mind with regards to their compliance.

If you are looking to shift focus off the routine tasks in your business and back to building your core business, then QBSS can help share the burden of your payroll, finance and accounting services to empower you to scale your business in a cost-effective way, regardless of a company’s size.