Blog Details

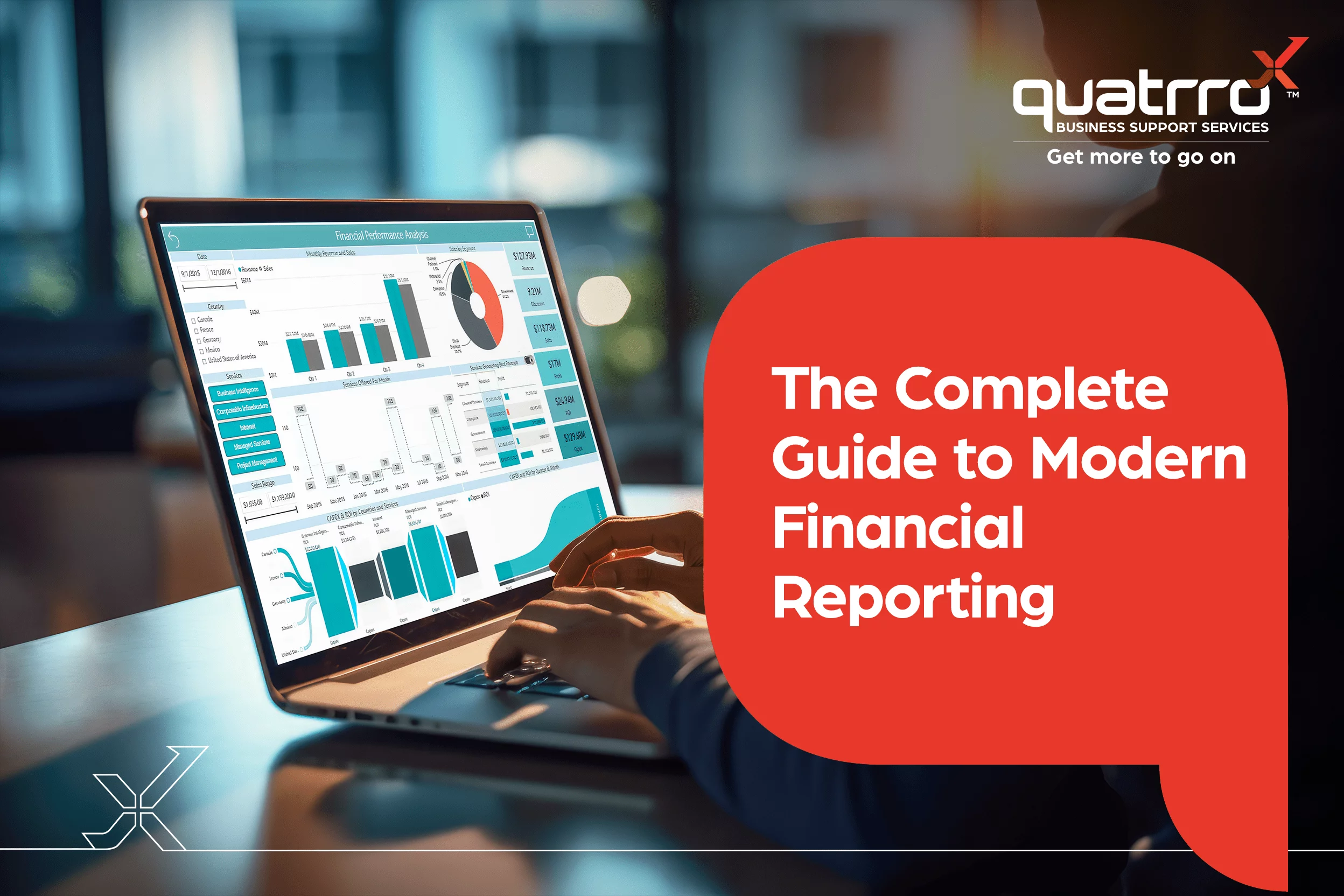

The Complete Guide to Modern Financial Reporting

December 5, 2023

With recent advances in technology, many businesses are adapting and updating the way they do financial reporting and how they develop their financial models for modern day demands necessary for growth. In many situations, decision-makers may require up-to-the-minute financial data to make informed choices and stay ahead of competitors. Investors, stakeholders and regulatory bodies are demanding greater transparency and accountability from organizations.

Modern financial reporting offers business leaders new opportunities to glean insights, identify trends and predict outcomes with greater accuracy.

What is Modern Financial Reporting?

Modern financial reporting is a comprehensive, analytics-driven approach that leverages technology to provide a real-time, holistic view of an organization's financial health. It goes beyond traditional financial statements and compliance-focused reporting, integrating multi- dimensional data analysis.

The advantage of modern financial reporting systems is the ability to combine financial data with operational metrics, providing a more nuanced understanding of where a company stands and where it is headed. Modern financial reporting solutions focus on forward-looking insights, predictive analytics and integration with business intelligence to support growth and innovation.

Modern financial reporting systems often leverage cloud integrations, which facilitate the centralization of data and provide scalable computing power to handle complex data analytics. Automation can streamline repetitive tasks, reduce the risk of human error and free up finance professionals to focus on more strategic activities. Collaboration tools embedded within modern financial reporting platforms enable cross-functional teams to work together seamlessly.

Despite the clear benefits, a surprisingly small percentage of organizations have fully adopted advanced reporting automation. This could be an opportunity for many organizations— the ones who take the steps to improve their financial reporting processes now, could gain efficiency and insights that may boost them ahead of competitors.

Why is Modernizing Your Financial Reporting Important?

Modern financial reporting solutions allow teams to do more in less time, and help organizations avoid costly mistakes.

One of the most important goals of financial reporting is to inform decisions, and modern systems provide a rich context for decision-makers. The C-suite in every organization requires a real-time snapshot of the company's financial health to make strategic decisions that could affect the business's trajectory. Outdated financial reports cause difficulties in an environment where market conditions and competitive landscapes can change rapidly.

Modern financial reporting systems offer the agility and real-time data access necessary for executives to make these critical decisions. Through live dashboards, data analytics and forecasting tools, financial reporting systems can give executives a thorough overview of a company’s financial situation at a glance.

Trust between an organization and its stakeholders is built on accurate, transparent financial reporting. Inaccuracies can lead to misinformed decisions, legal consequences and damaged reputations. Modern financial reporting, with its automated data collection and processing capabilities, significantly reduces the risk of human error.

In the past, financial teams spent countless hours collecting data, reconciling discrepancies and preparing reports. Modern solutions dramatically cut down this time, enabling finance teams to deliver critical financial insights without delay and enhancing the responsiveness of the entire organization to financial trends and alerts. Anomaly detection algorithms highlight outliers in the data, allowing teams to quickly investigate and resolve issues.

Traditional tools such as spreadsheets can be prone to error and difficult to audit, may lack in- depth collaborative features, and are not built to handle the volume and complexity of data that businesses now generate. Moreover, spreadsheets can become unwieldy as a business grows, leading to fragmented data and reporting inconsistencies.

Spreadsheets also struggle with data integrity, particularly when multiple users input and manipulate data. The risk of overwriting important information, formula errors and broken links is high.

Financial reporting must keep pace with the expanding regulatory landscape, ensuring compliance and avoiding potential legal repercussions. A good automated financial reporting platform will ensure your reporting is always compliant with any changes to local financial regulations.

Best Practices in Modern Financial Reporting

Modern financial reporting can help businesses make their reporting processes faster, more reliable and less labor-intensive. However, it does have its own set of possible challenges that business leaders should consider and adjust for when creating workflows.

Even with the availability of data, finance teams can spend considerable time manually consolidating and verifying data for accuracy. Manual data consolidation and accuracy checks can become bottlenecks in the reporting process. To solve this, you can automate data collection and validation processes using financial software that integrates with various data sources. Implement ETL (Extract, Transform, Load) systems that automatically prepare data for analysis.

Many organizations rely heavily on spreadsheets due to their flexibility, which can make migrating to more sophisticated systems seem daunting. To make the transition easier, you can adopt a phased approach to system migration, where spreadsheet data is gradually integrated into new financial systems and proper change management is executed to support process updates to the new workflow..

Businesses should provide comprehensive training and support to all impacted teams to ensure a smooth transition to their modern financial reporting. Ongoing training and education for all key stakeholders, but especially to finance teams, on the latest financial reporting tools and practices will help keep them up to date.

To avoid costly customization services, choose a scalable financial reporting system that offers modular customization options. This allows organizations to tailor the system to their needs without incurring significant costs. Open-source or cloud-based financial tools can also be cost-effective alternatives with high adaptability.

Transitioning to Modern Financial Reporting

Modern financial reporting, driven by advanced technology and analytical tools, is essential for businesses aiming for sustainable growth and operational excellence. By harnessing the power of real-time data, predictive analytics and comprehensive automation, modern financial reporting transforms raw numbers into strategic assets, empowering businesses to make proactive, informed decisions.

However, the transition to modern reporting systems requires a deliberate and structured approach. As organizations consider upgrading their financial reporting infrastructure it can be important to partner with seasoned experts who can guide the transition..

Quatrro Business Support Services helps businesses modernize their financial reporting seamlessly. With QBSS's expertise, companies can unlock the full potential of their financial data, ensuring accuracy, compliance and strategic insights. We understand that every organization's journey toward modern financial reporting is unique, and we are here to provide the guidance, technology and support required to navigate this journey successfully. Embrace the future of financial reporting with QBSS!